PREMIUM PROPERTIES. POWERFUL PRESENCE.

Frances serves a sophisticated and international clientele, with contacts in the US, Europe, Australia, Asia, and the Middle East. This helps maximize demand for her clients, especially given the increasingly global bid for New York City real estate.

Frances possesses a sharp and detailed memory for real estate data, such as apartment layouts, building histories, existing and pending new developments, resale comparables, pricing, and the historical financial performance of neighborhoods, buildings and apartments.

This knowledge, along with a deep rolodex and an appreciation for her clients desire for premium service, discretion, and efficiency, has earned Frances the loyalties of financiers, celebrities, real estate investors, developers, and the art culture of New York City.

In addition, buyers and sellers alike benefit from her honest and straight forward approach to real estate, investment analysis, and her creative financial consultation.

Frances serves a sophisticated and international clientele, with contacts in the US, Europe, Australia, Asia, and the Middle East. This helps maximize demand for her clients, especially given the increasingly global bid for New York City real estate.

Frances possesses a sharp and detailed memory for real estate data, such as apartment layouts, building histories, existing and pending new developments, resale comparables, pricing, and the historical financial performance of neighborhoods, buildings and apartments.

This knowledge, along with a deep rolodex and an appreciation for her clients desire for premium service, discretion, and efficiency, has earned Frances the loyalties of financiers, celebrities, real estate investors, developers, and the art culture of New York City.

In addition, buyers and sellers alike benefit from her honest and straight forward approach to real estate, investment analysis, and her creative financial consultation.

PROVIDING CRUCIAL UP TO THE MINUTE REAL ESTATE DATA – WITH A PULSE ON THE NYC PROPERTY MARKET. THIS IS YOUR REAL ESTATE RESOURCE, PROVIDING MARKET INSIGHTS NOT AVAILABLE ANYWHERE ELSE.

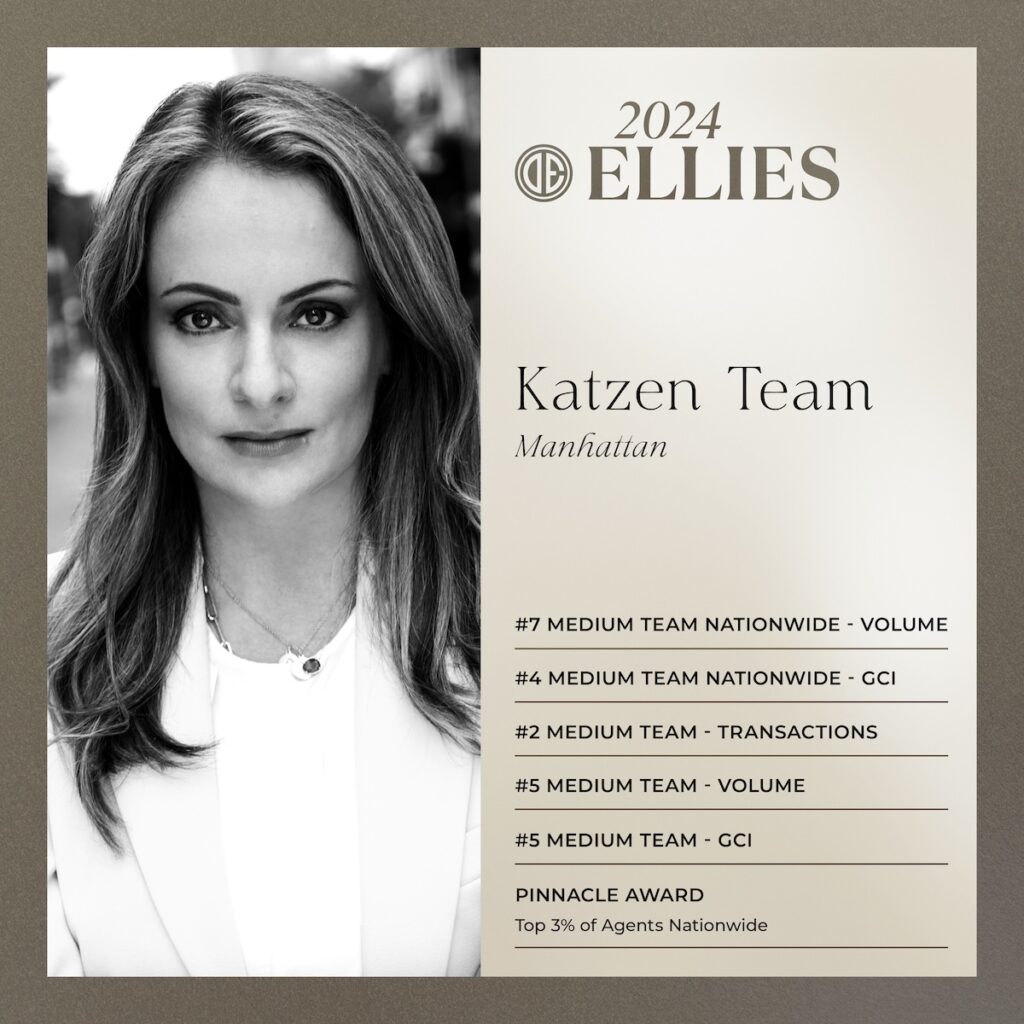

THE KATZEN TEAM

is proud to have received the following

Douglas Elliman “Ellies” Awards for 2024!

#4 Top Achievements in GCI – Medium Teams – Manhattan

#5 Top Achievements in Volume – Medium Teams – Manhattan

#2 Transactions – Medium Teams – Manhattan

#4 Medium Team Nationwide GCI

#7 Volume Pinnacle Award – Medium Teams – Nationwide

THE KATZEN TEAM

is proud to have received the following

Douglas Elliman “Ellies” Awards for 2024!

#4 Top Achievements in GCI – Medium Teams – Manhattan

#5 Top Achievements in Volume – Medium Teams – Manhattan

#2 Transactions – Medium Teams – Manhattan

#4 Medium Team Nationwide GCI

#7 Volume Pinnacle Award – Medium Teams – Nationwide

Testimonials

I feel fortunate to have found and worked with Frances Katzen and her team. They made it easy, efficient, and seamless.

My place sold within days of being on the market. With my approval, Fran and her team managed the conversations with all the relevant stakeholders on my behalf to get the home sold for the maximum price.

Ongoing communication was excellent, and they took the worry and hassle away from me.

This has been honestly the best real estate transaction I have ever been a part of.

Over the last 6 years Fran has helped me sell three condominiums in Manhattan. Most recently our collaboration included the sale of an apartment in Midtown. Despite the difficult market conditions, Fran and her team helped develop a selling strategy that reimagined the apartments space and look...a necessity in this environment.

I chose Fran because of her professionalism and insight. I'm so glad I did as the property went to contract soon after listing.

It was thanks to her professionalism, composure, knowledge and resolution based thinking that the sale eventually occurred. If given the opportunity to sell another NYC apartment, I would only utilize her services and would therefore unequivocally recommend her to others.

Over the last 6 years Fran has helped me sell three condominiums in Manhattan. Most recently our collaboration included the sale of an apartment in Midtown. Despite the difficult market conditions, Fran and her team helped develop a selling strategy that reimagined the apartments space and look...a necessity in this environment.

I chose Fran because of her professionalism and insight. I'm so glad I did as the property went to contract soon after listing.

I very much recommend her Team !

We just wanted to thank you for your help, professionalism, your outstanding way to answer so promptly all our questions.

It's has been a real pleasure to work with you and I am sure we will work again very soon all together on our next project.

& Steven Banchik

I hope to work with you again,

CONNECT WITH FRANCES